In general, a larger down payment can make a significant different on not only your monthly payment, but also the total amount of interest you pay over the life of the loan. To compare the impact of different down payments on the total interest paid over time, let’s consider a simple example using a fixed interest rate mortgage. Here’s how it looks:

Assumptions:

-

Loan Amount (Home Price): $300,000

-

Interest Rate: 4% (fixed)

-

Loan Term: 30 years

Down Payment Scenarios:

-

Down Payment: 5% ($15,000)

-

Down Payment: 10% ($30,000)

-

Down Payment: 20% ($60,000)

Monthly Payments Calculation:

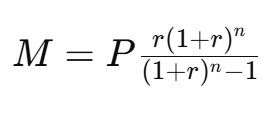

Using a mortgage calculator or formula, we can determine the monthly payments for each down payment scenario. The formula for the monthly payment (M) is:

Where:

-

P = Loan amount

-

r = Monthly interest rate (annual rate / 12)

-

n = Number of payments (loan term in months)

Results:

| Down Payment | Loan Amount | Monthly Payment | Total Payments | Total Interest Paid |

|---|---|---|---|---|

| 5% ($15,000) | $285,000 | $1,359 | $488,622 | $203,622 |

| 10% ($30,000) | $270,000 | $1,287 | $462,304 | $192,304 |

| 20% ($60,000) | $240,000 | $1,145 | $412,720 | $172,720 |

Summary of Interest Savings:

-

5% Down Payment: Total interest paid = $203,622

-

10% Down Payment: Total interest paid = $192,304

-

20% Down Payment: Total interest paid = $172,720

Interest Savings:

-

5% to 10% Down Payment: Savings of $11,318

-

10% to 20% Down Payment: Savings of $19,584

-

5% to 20% Down Payment: Total savings of $30,902

Conclusion:

By comparing these figures, you can see that a difference of 5% more down up front saved over 10k over time, and the savings only went up from there. More down can also affect the amount of mortgage insurance you are required to pay, as most loans required Private Mortgage Insurance (PMI) until 20% equity is reached.

So, the general rule is that higher down payments lead to lower monthly payments and significant interest savings over the life of the loan. This can greatly reduce the overall cost of the mortgage, and may mean that even if your loan program allows for a smaller amount down, if you can afford to put more down, it can really help you in the long run.

However, we will mention that there are scenarios in which it makes financial sense to put less down. Check out our blog post on when it's a good idea to put 0% down.

If you need a more detailed analysis or specific numbers adjusted to different scenarios, just reach out to use and we can help!