Real Estate Investors

Utilize our lender marketplace and access industry low rates and flexible guidelines for DSCR and Rental Property Loans

Rental Property DSCR Loans

Renovation & Rehab Financing

Blanket Portfolio Loans

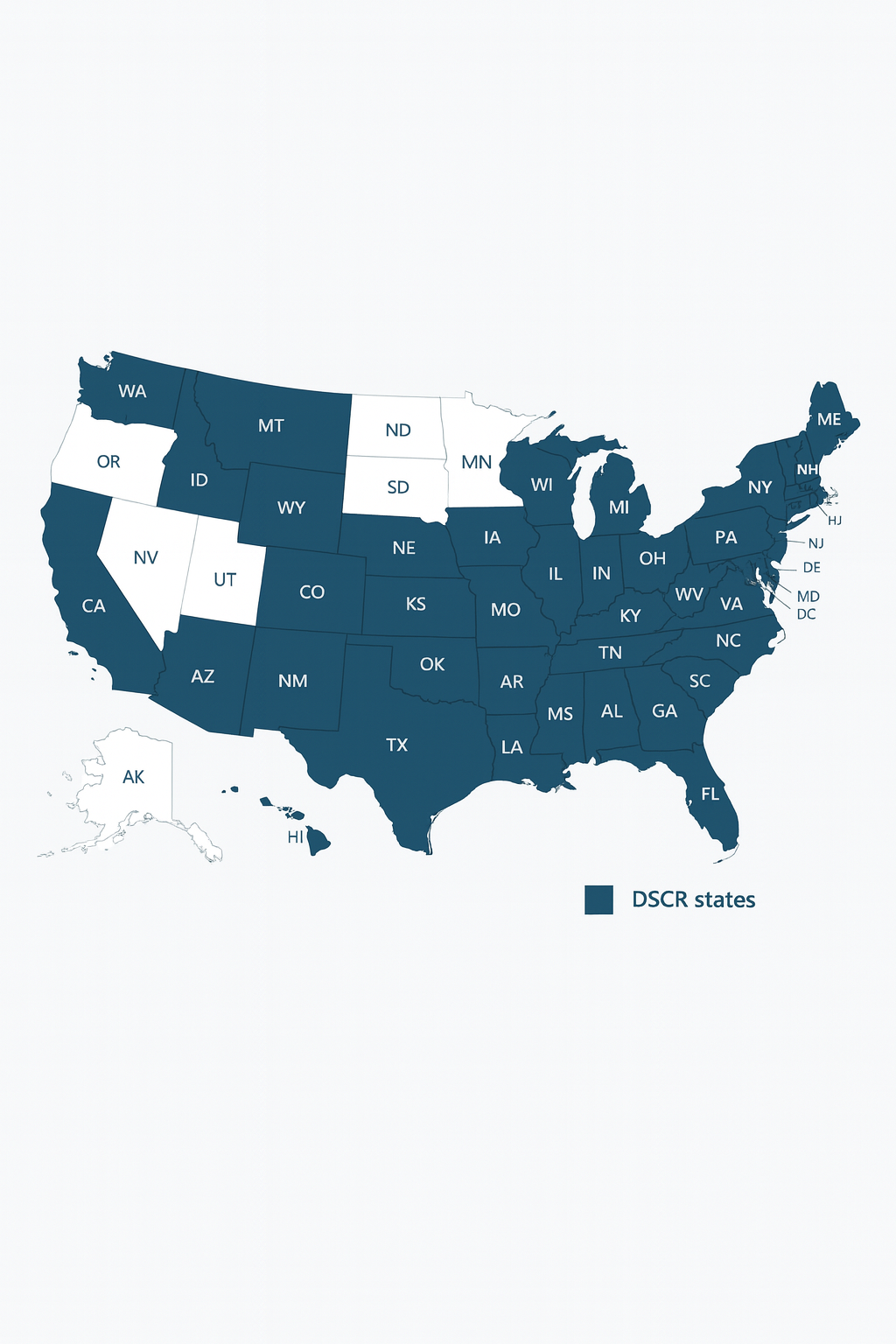

Lending Options in 40+ States

Business Purpose Loans

*Available in all states excluding

AK, ND, NV, OR, UT, SD, MN at this time

How It Works

We review pricing, guidelines, and programs to find the solutions that fit your scenario — while securing financing at reduced wholesale pricing, shown to save clients $10,000+ over the life of the loan.

Application

Review credits, assets, and property estimated cash flow. Complete online application, no employment or income needed.

Loan Underwriting

Submit business purpose declaration, ID, bank statements, and LLC docs. We order appraisal, title, and insurance.

Clear to Close

Once all documentation is cleared, we are good to schedule closing.

Frequently Asked

What is a DSCR loan?

A DSCR loan is a type of mortgage that qualifies borrowers based on the income (or estimated income) generated by the investment property (e.g., rental income) rather than the borrower’s personal income. The key metric is the Debt Service Coverage Ratio (DSCR).

How is DSCR calculated?

It’s calculated by dividing the property’s total rental income by the total mortgage payment. If the DSCR ratio is 1 or higher, the pricing is very good. If it falls below 1, you can still do the loan, but it often requires a hit in pricing or a larger down payment.

What if the property doesn't cash flow right now?

We have loan options even for non cash-flowing properties. These are called no-ratio DSCR loans. They usually require a larger down payment and good credit.

What types of properties qualify?

DSCR loans can be used for investment properties like single-family homes, multi-family units, condos, townhomes, or even short-term rental properties like vacation homes (Airbnbs).

Do I have to do a DSCR loan?

No. DSCR allows for a simple process for real estate investors requiring no income or employment check. It is based on credit, assets and the properties cash flow. If you would like to look at doing a full documentation process instead of DSCR, let us know and we can review your conventional options.

Are DSCR rates good?

DSCR rates can be right in line with conventional investment property financing depending on the property. We have certain programs that are below conventional loan pricing right now. In order to get best pricing on a DSCR loan, it does require a prepayment penalty.

Does every DSCR have a Prepayment Penalty?

No, not every DSCR needs to have a prepayment penalty but it will affect the pricing of the deal. You can take anything from 0 prepayment penalty to a 5 year prepayment penalty. The penalty is usually 5% of the amount that you payoff early. Investors that plan on holding the home for a while and not refinancing often take a 3-5 year prepayment penalty to maximize cashflow.

How long does the process take?

We do same day processing and UW turn times on most loans. We have closed as quickly as 7 business days, and generally close within 10-14 business days. The quicker that you can provide documentation, the quicker we can close.

Contact us Today!

We’re happy to answer questions or help you get started.

Call or Text

Email Us

Get Quote

©2025 BoniFi Capital LLC. NMLS 2664654.

All rights reserved.

This site is not authorized by the New York State Department of Financial Services. No mortgage solicitation activity or loan applications for properties located in the State of New York can be facilitated through this site.

BoniFi Capital is a mortgage brokerage. All loans arranged through third-party lenders. Rates and terms subject to change.

Not all programs available in all states.

Currently serving PA, FL, and DSCR investors nationwide in 40+ states.

Matthew 22:37-39